DD - LEU (Centrus Energy Corp)

Let’s "blow" this thing wide open, shall we? *pun intended.

We’ll kick off this DD by zooming out, taking a big, macro look at the world, and then gradually zooming in, step by step. Think of it like a pyramid: we’ll start with the broad base, figure out the direction it’s moving, and then work our way layer by layer toward the sharp point at the top. You’ll see what I mean as we go. So let’s get started, zoomed all the way out with a 1000-yard perspective.

Can't be bothered reading this report? Below is a summary video, skip to the 20min mark if you only care about this due diligence report.

Summary of Report

Part 1: The world needs more energy

Global energy demand is climbing higher. In 2024 it jumped about 2.2%, almost double the average pace of the last decade. Most of that is coming from electricity use, which spiked over 4% thanks to hotter summers, colder winters, and the insane growth of data centres, EVs, and just about everything digital. Emerging markets are driving a big chunk of this, but the West isn’t slowing down either. And here’s the kicker: efficiency gains aren’t keeping up. We’re using more juice faster than we’re learning how to save it. Demand curve keeps pointing up.

What proof do I have? Well, I read the entire IEA Global Energy Review 2025 report so you don't have to. here are my summarised findings out of that report:

🌍 Global Energy Snapshot (IEA Global Energy Review 2025)

- Demand climbing higher: Global energy demand jumped +2.2% in 2024, almost 2x the average pace of the last decade.

- Electricity is the driver: Power use surged +4.3%, the biggest jump ever outside of post-recession rebounds.

- Emerging markets = the engine: India’s growth outpaced all advanced economies combined. China still leads, US was #3.

- Fossil fuels slipping, but not gone:

- Oil demand growth slowed to +0.8%, dropping below 30% of total energy share for the first time in history.

- Natural gas up +2.7%, fastest-growing fossil fuel.

- Coal demand hit another record high (+1%), China burns 40% more than the rest of the world combined.

- Clean energy momentum:

- Renewables + nuclear delivered 80% of new electricity generation in 2024.

- Renewables and nuclear now supply 40% of total global power.

- Nuclear added 7 GW new capacity, construction starts up 50% YoY (China, Russia leading).

- AI & digital demand boom: Data centres + AI computing added ~15 GW in 2024 alone - a whole new source of energy stress.

- Efficiency falling behind: Energy efficiency gains aren’t keeping pace with demand growth.

- Emissions still climbing: CO₂ hit a record 37.8 Gt in 2024, up 0.8%. Advanced economies cut slightly, but emerging markets still ramping.

In a nutshell: Energy demand is climbing faster than renewables can scale. Fossil fuels are plateauing, nuclear is creeping back, and the system needs stable, scalable baseload power. That’s where nuclear energy has entered the chat.

Part 2: What's the solution?

In my opinion, nuclear energy is the solution.

Hear me out...

Global electricity demand is rising at its fastest pace in decades, fuelled by EVs, data centres, industrial growth, and extreme weather. Renewables are scaling quickly, but their intermittency creates reliability gaps that fossil fuels can no longer fill efficiently or sustainably. Coal is plateauing, gas is increasingly used as backup rather than baseload, and oil is virtually absent in power generation. This leaves a widening gap between the relentless growth in demand and the stable supply the grid requires. Nuclear energy stands out as one of the only proven technologies that can deliver large-scale, carbon-free, 24/7 baseload power. With many countries extending the life of existing plants and building new capacity, including advanced small modular reactors, nuclear is uniquely positioned to step in where both fossil fuels and renewables fall short.

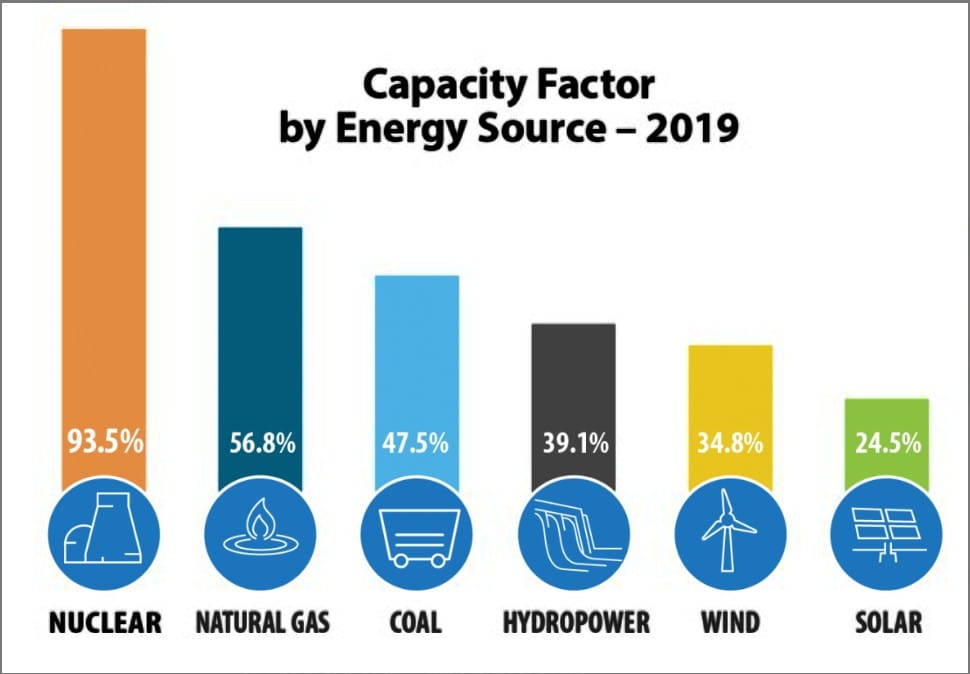

How much better is nuclear energy than other energy sources? Lets first look at capacity factors of different energy sources:

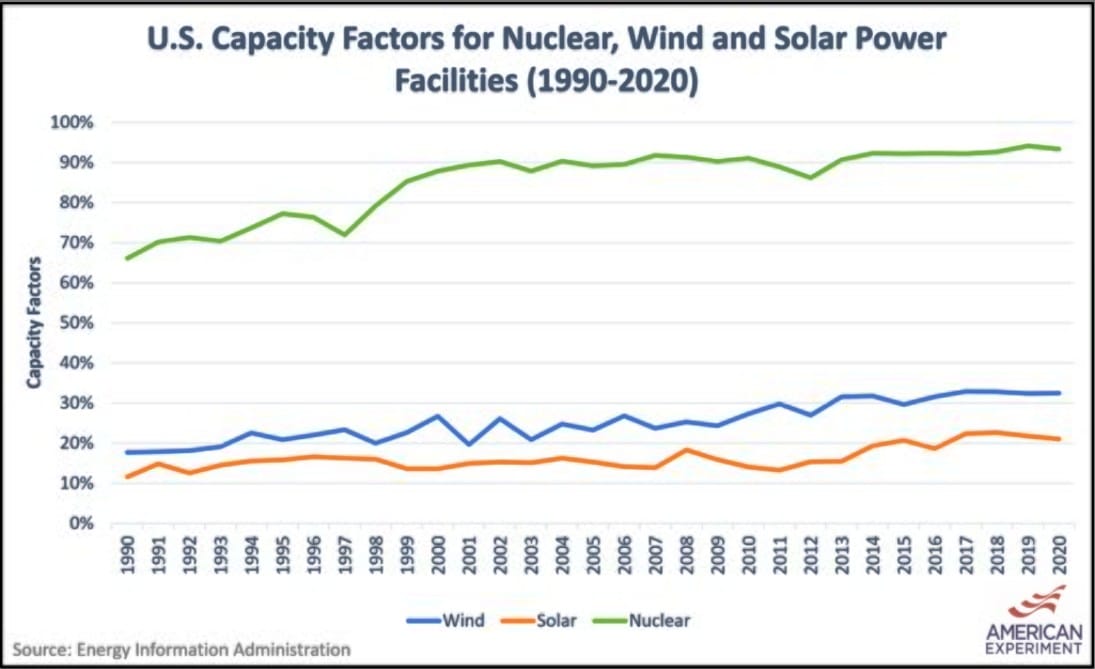

The data speaks for itself, nuclear runs at a stunning 93.5% capacity factor, nearly double coal and gas, and 3-4x higher than wind or solar. And this isn’t a fluke, the second chart shows nuclear has consistently delivered near-full power for decades, while renewables have lagged far behind. Bottom line: nuclear is the only carbon-free source that actually works around the clock.

To put it in perspective: one uranium fuel pellet (about the size of your fingertip) generates as much energy as 1 ton of coal, 120 gallons of oil, or 17,000 cubic feet of natural gas. And for solar? You’d need roughly 5 full football fields covered in panels, running flat-out for a year, just to match the output of that single pellet. The sheer energy density of nuclear dwarfs everything else, which is exactly why it’s the only real contender to keep pace with rising global energy demand.

Cost...

The best way to compare the cost of different energy sources is through the Levelized Cost of Energy (LCOE). LCOE measures the average cost to generate one megawatt-hour (MWh) of electricity over a plant’s lifetime. It factors in everything, construction costs, fuel, operations, and maintenance, making it a true “all-in price per unit of electricity.” Because it accounts for the full lifecycle, LCOE is widely seen as the fairest way to stack energy sources side by side.

The Comparisons (based on IEA, Lazard, and U.S. EIA data)

(numbers vary by region, but here’s a ballpark from 2023 reports)

- Nuclear: ~$60–$80 per MWh (higher upfront cost, but stable long-term)

- Natural Gas (combined cycle): ~$45–$70 per MWh (cheap now, but volatile with fuel prices)

- Coal: ~$70–$120 per MWh (getting more expensive with carbon costs + pollution controls)

- Wind: ~$30–$50 per MWh (cheapest in windy regions, but intermittent)

- Solar PV: ~$30–$40 per MWh (very cheap, but only when the sun shines → needs backup/storage)

When you line up the numbers, nuclear doesn’t look like the cheapest source of electricity today, wind and solar usually come in lower on a pure LCOE basis. Natural gas also competes strongly in the short term, though its costs are tied to volatile fuel prices. Coal, once the backbone of global electricity, is now often the most expensive option due to rising carbon costs and stricter pollution controls. Nuclear tends to land in the middle of the pack, around $60–$80 per MWh, but what makes it stand out is its stability: once a plant is built, it delivers steady, low-cost power for decades without exposure to fuel price swings.

The real challenge for nuclear has always been the upfront build cost, constructing a large-scale reactor takes billions and years of lead time. But that’s where Small Modular Reactors (SMRs) are starting to change the equation. SMRs are designed to be cheaper, faster to build, and easier to scale, which could push nuclear costs down significantly in the future. If that happens, nuclear won’t just be reliable, it could become one of the most cost-competitive clean energy sources on the planet.

Let's address the elephant in the room, isn't nuclear dangerous?

Whenever nuclear power comes up, people immediately think of Chernobyl, Fukushima, or Three Mile Island. Those disasters left a huge scar on public perception, and it’s fair to ask: is nuclear still risky?

The short answer: nuclear today is far safer than it was decades ago. The technology, regulation, and safety systems have advanced massively. Modern plants are built with “passive safety systems”, meaning that even if operators do nothing and power goes out, the reactors are designed to shut themselves down safely. This is a big difference from older designs that relied heavily on human intervention.

On top of that, the industry is moving toward Small Modular Reactors (SMRs), which use smaller cores and advanced cooling systems that virtually eliminate meltdown risk. And the numbers back this up: per unit of electricity generated, nuclear has fewer deaths than coal, oil, or even hydropower accidents (source: Our World in Data, WHO studies).

That said, the fear isn’t irrational, accidents can happen, and when they do, the consequences can be severe. But the reality is nuclear safety has improved to the point where statistically it’s one of the safest energy sources in the world today. The bigger “risk” right now isn’t meltdown, it’s public perception and political resistance.

Deaths per Unit of Electricity (deaths per terawatt-hour, TWh)

- Coal: ~24.6 deaths/TWh (mostly air pollution and mining accidents)

- Oil: ~18.4 deaths/TWh

- Natural Gas: ~2.8 deaths/TWh

- Biomass: ~4.6 deaths/TWh

- Hydropower: ~1.3 deaths/TWh (most deaths tied to rare dam failures, like Banqiao in 1975)

- Wind: ~0.04 deaths/TWh

- Solar: ~0.02 deaths/TWh

- Nuclear: ~0.03 deaths/TWh (includes Chernobyl + Fukushima)

💡 Takeaway: Even when you factor in every major nuclear accident in history, nuclear still kills fewer people per unit of energy than fossil fuels by orders of magnitude. Coal is about 800x deadlier than nuclear.

Global politics

Regardless of the anti-nuclear spin you might see on social media or in the mainstream press, here’s what’s actually happening in the real world:

Global politics are turning increasingly pro-nuclear. This year (2025), nuclear generation is set to hit a record, driven by reactor restarts in Japan, new builds in China and India, and a wave of policy shifts in Europe. At COP29, 31 countries, including the U.S., Canada, and the U.K. signed a declaration to triple global nuclear capacity by 2050, with newcomers like Nigeria, Kazakhstan, and Türkiye joining in. The EU has also legally confirmed nuclear as a “green” investment under its taxonomy, unlocking more financial flows.

The drivers are clear: governments need energy security, climate solutions, and stable baseload power. Nuclear delivers all three with near-zero carbon emissions, unlike volatile fossil fuels or intermittent renewables. Advances in technology, especially Small Modular Reactors (SMRs), are making nuclear cheaper, faster to build, and politically easier to support. Challenges remain, high upfront costs, long permitting times, and waste management, but the global policy trend is decisively shifting toward nuclear as a core piece of the clean energy mix.

Part 2 summary:

In short, the world’s energy demand is climbing fast, fossil fuels are plateauing, and renewables alone can’t reliably carry the load. Nuclear stands out as the only proven, carbon-free, 24/7 baseload power source that can scale. With global politics shifting in its favour and new technologies like SMRs on the horizon, nuclear is no longer a backup option, it’s the centrepiece of the solution.

Part 3: What's the Play?

So, we’ve set the thesis: the world needs more energy, and nuclear is the only scalable, zero-carbon, high-capacity, ultra-efficient option. The question now is simple, what’s the play? How do we turn this into profit?

This is where the real DD begins. From here, we dive into the market to find the best investment opportunities, the ones with the highest upside and the strongest odds of paying off. Think of it as an investor’s chess match: every move counts, and the goal is to position ourselves to win, whether the market likes it or not.

A simple, safe, and frankly boring play would be to park money in a diversified uranium ETF like URA, or a nuclear energy ETF like NLR. But let’s be real, if you’re here, you’re not looking for vanilla index exposure. You’re here for leverage, and the biggest upside will always come from single-stock plays.

Within the nuclear world, there are several sub-sectors that all stand to benefit from rising global energy demand:

- Uranium miners – the raw material suppliers.

- Uranium enrichment / nuclear fuel companies – converting raw ore into usable fuel.

- Nuclear power plant operators & utilities – generating electricity directly.

- Component & engineering suppliers – building and maintaining reactors.

- Small Modular Reactor (SMR) developers – the “new wave” of nuclear.

Okay, let’s rule out some plays I’m not a big fan of right off the bat:

uranium miners:

Funny enough, I work in the mines of Western Australia, one of the largest mining regions in the world, for the past 7 years. And I mean actually on site (in the middle of the outback), both underground, surface, and in the corporate office. On top of that, I’ve invested in plenty of ASX-listed mining stocks over the last decade, and let me tell you: they have almost always lost me money lol.

The mining game is a very tough way to make money as an investor. It’s loaded with sketchy “start-up” exploration companies that aren’t exploring much except the wallets of their investors. Even the established players are volatile, debt-ridden, and incredibly inefficient. The few that are stable have basically traded sideways for 20 years and are so diversified that when one resource in their portfolio goes up, another drags them back down.

The biggest uranium mining companies also dig up every other resource under the sun, which makes it nearly impossible to get pure uranium exposure. Unless you’re willing to take a wild punt on a tiny uranium junior (most of which are closer to scams than businesses), it’s like buying a lottery ticket.

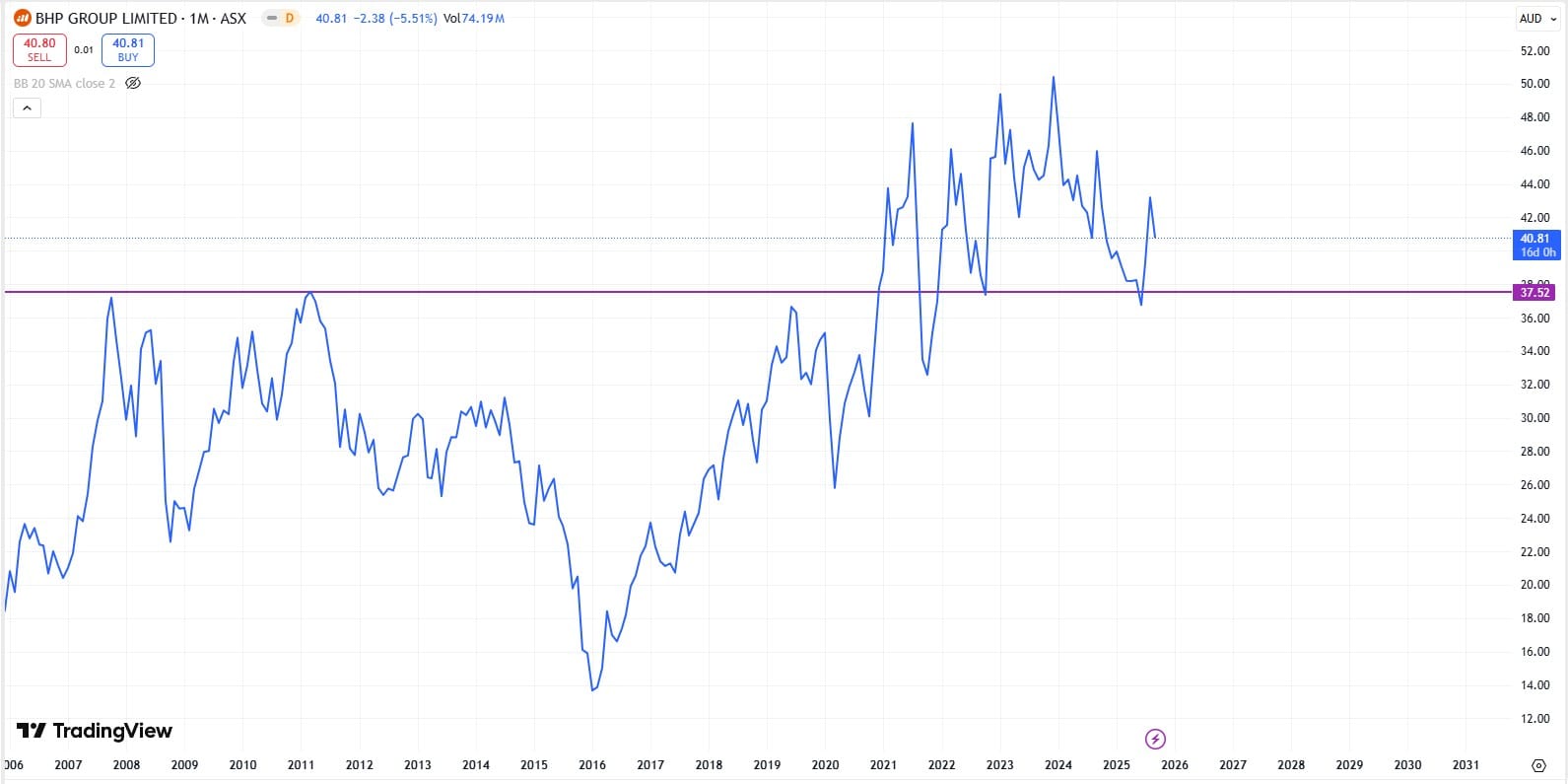

For context: BHP owns Olympic Dam, the largest uranium deposit in the world. Below is the price chart of BHP, basically trading at the same levels it was 20 years ago. Not exactly the rocket ship exposure you’d want if you’re betting on a uranium boom.

Another issue with betting on mining companies is this: anyone can do it. Sure, it’s not “easy” to start a mining company, but it’s not some secret rocket-science formula either. Take gold, for example. If the price of gold doubles, what happens? Gold mining companies pop up everywhere like warts. That flood of new supply then drives the price back down, bankrupting the weakest players, cutting supply again, and sending prices right back up. It’s a messy, endless cycle, and uranium miners are no different.

But here’s the real kicker: unlike gold, uranium isn’t even that rare. Uranium is actually one of the most common elements in the Earth’s crust, more common than tin, mercury, or silver. There are known uranium resources spread across dozens of countries, with massive untapped reserves still in the ground. The problem isn’t scarcity; it’s economics. Mining and refining uranium safely takes serious capital, strict regulation, and long lead times. So while uranium itself isn’t rare, usable nuclear fuel is much harder to come by, and that’s why the real play in NOT uranium miners.

Here is a quick bullet point run down on the uranium process from mining to enrichment:

- Step 1 – Mining: Uranium ore is dug up from mines. But raw ore is useless, it’s just dirt with ~0.1–1% uranium content.

- Step 2 – Milling: The ore is processed into yellowcake (U₃O₈), which is a concentrated powder. This is what most mining companies sell.

- Step 3 – Conversion & Enrichment: This is the *key choke point*. Most reactors need uranium that’s enriched to 3–5% U-235 (the isotope that actually fissions). Natural uranium only has 0.7% U-235. To make reactor fuel, you need sophisticated enrichment facilities, expensive, heavily regulated, and concentrated in only a few countries.

- Step 4 – Fuel Fabrication: The enriched uranium is then made into fuel rods, which power reactors.

The key choke point gives us a clear signal about where this DD is heading. So let’s be real: betting on a uranium mining company is, in my view, a dead end. The real play is in the bottleneck, that’s where the leverage and upside live. But before we zoom in, let’s quickly rule out a few other categories: nuclear power plant operators & utilities, component & engineering suppliers, and Small Modular Reactor (SMR) developers.

nuclear power plant operators & utilities:

Boring, next.

This is basically a bet on utilities, boring, safe and inactive. Yeah, boring. These are essentially just utility companies, safe, slow-moving, dividend-paying, and heavily regulated. You’re not betting on growth here, you’re betting on stability. If your goal is to clip a 3–4% dividend and sleep well at night, fine, but this isn’t the kind of asymmetric upside we’re hunting for in a DD like this.

component & engineering suppliers:

Honestly, not a bad play. If nuclear reactors start rolling out in higher numbers, the guys building the pipes, pumps, valves, and engineering systems get paid every single time. It’s less about uranium prices and more about infrastructure demand. It’s a steady leverage to the nuclear buildout.

👉 If you’re interested in this angle, BWX Technologies (BWXT) is a solid example, they supply nuclear components and services, including work for the U.S. government.

Modular Reactor (SMR) developers:

This is the sector getting all the buzz. SMRs (Small Modular Reactors) are basically nuclear power plants shrunk down into scalable, factory-built modules. Instead of taking 10–15 years and billions to build one giant plant, SMRs promise faster builds, lower upfront costs, and easier financing. Governments love them because they’re safer, flexible, and can slot into grids alongside renewables. Investors love them because they represent the “next wave” of nuclear adoption.

The downside? Most SMR companies are still early-stage and highly speculative, a lot of promises, not much revenue yet. But if SMRs deliver, early investors could be holding a golden ticket.

👉 One of the most talked-about names here is NuScale Power (SMR), though keep in mind it’s still a high-risk play with volatility baked in.

Here's a quick pros/cons bullet point:

Pros of SMRs:

- Lower upfront cost vs. traditional nuclear plants.

- Factory-built → faster deployment and easier scaling.

- Smaller footprint → can be placed closer to demand centres or industrial sites.

- Strong government and policy support (subsidies, grants, and pilot projects).

- Safer designs with passive cooling systems.

Cons of SMRs:

- Still mostly unproven at scale (few, if any, commercial deployments).

- Long regulatory and permitting timelines remain.

- Competing technologies (fusion, advanced renewables + storage) may steal the spotlight.

- High risk/high reward for investors, many SMR developers are pre-revenue and speculative.

As of mid-2025, there are no publicly listed companies that own and operate a commercial SMR that is fully online and delivering grid-scale power. Most SMR developers are still in design, licensing, or early construction phases.

My thoughts on an SMR investment: it’s the definition of high risk, high reward. You’re essentially betting on a pre-revenue prototype. If it works and you happen to pick the right company, it could be a life-changing play, millionaire-making levels of upside. But in the meantime, these companies burn cash, pile on debt, and dilute shareholders just to stay alive. It’s a long shot. Maybe one of them does become the next NVDA… but good luck. I personally don't have the time, the risk tolerance or the patience for that to happen.

This leaves us with one last option, Uranium enrichment / nuclear fuel companies.

Uranium enrichment / nuclear fuel companies

This is where the real bottleneck lies. Unlike miners, utilities, or even SMR developers, uranium enrichment / nuclear fuel companies sit at the core of the supply chain. They’re the ones who turn raw uranium into usable fuel, and that demand exists no matter what. If SMRs succeed, great, demand skyrockets. If they don’t, enrichment is still essential for every reactor already running and every new one being built. In short, this sector profits regardless.

To understand why enrichment is the choke point, you need to know what it actually is. Natural uranium straight out of the ground is mostly U-238, which doesn’t do much in a reactor. What you need is U-235, the fissile isotope. Trouble is, only about 0.7% of natural uranium is U-235. That’s where enrichment comes in, spinning uranium hexafluoride gas in massive centrifuge cascades until the concentration of U-235 rises to reactor-grade levels.

- LEU (Low-Enriched Uranium): This is the standard fuel for today’s large reactors, enriched to about 3–5% U-235.

- HALEU (High-Assay Low-Enriched Uranium): The next frontier. Enriched up to 19.75% U-235, it’s essential for most SMRs and advanced reactor designs.

Here’s the kicker: enrichment is really hard to do. It requires highly specialized centrifuge technology, enormous capital investment, regulatory oversight (because weapons-grade uranium starts above 20%), and decades of know-how. That’s why so few companies globally can even attempt it. Right now, Russia dominates global enrichment capacity, and the U.S. is scrambling to rebuild its own.

Let's pass it over to our boy Neil for a quick summary on the uranium enrichment process:

Fun fact: the U.S. barely produces any of its own enriched uranium and buys most of it from Russia.

Wait a second… The U.S., the world’s biggest military and economic superpower, doesn’t enrich its own uranium and instead imports it from its biggest geopolitical rival? WHAT THE ACTUAL F***.

If a war kicks off, how screwed are they? If Russia really wanted to twist the knife, they could simply stop selling enriched uranium tomorrow. And when you realize that SMRs (Small Modular Reactors) are designed to run on HALEU, uranium enriched up to 20%, things get even spicier. Why? Because weapons-grade uranium starts above 20%. So yeah, relying on Russia (or anyone else) for that is not exactly the smartest long-term plan.

We digress, here’s the history: for decades the U.S. was the world leader in uranium enrichment, running massive facilities like Portsmouth and Paducah that supplied both domestic reactors and a huge chunk of the global market. Then, in the 1990s and 2000s, those plants were shut down, and America basically walked away from enrichment. Imports, mostly from Russia and its allies filled the gap.

Now fast forward to today: energy security and geopolitics are front and centre again. Washington has officially labelled HALEU as “critical” for the future of SMRs and advanced reactors. Billions in funding are being thrown at kickstarting a domestic enrichment industry again. In other words, America went from dominating enrichment, to abandoning it, and now they’re scrambling to rebuild it from scratch.

And here’s the key takeaway: miners can pop up overnight, utilities just flip switches, but enrichment companies? They’re in a class of their own. Without enrichment, no reactor, big, small, or modular, runs. This is where the real leverage in the nuclear trade sits.

Part 3 Summary:

So here’s where we land: uranium miners are messy, utilities are boring, component suppliers are steady but limited, and SMRs are still moon-shot prototypes. The real leverage, the choke point, is enrichment. Without enriched uranium, nothing runs. And right now, the U.S. barely produces any of its own fuel, relying heavily on imports (including Russia). That’s why Washington is throwing billions at rebuilding domestic enrichment, especially for HALEU, which SMRs and advanced reactors will need.

In short: enrichment isn’t just another box in the nuclear supply chain, it is the bottleneck. And if you want exposure to that upside, there’s really only one pure-play stock in town.

Part 4: What Stock Do We Buy?

Well, there’s really only one option here: Centrus Energy Corp (Ticker: LEU). Seriously, this is it. Centrus is the only U.S.-listed, publicly traded company actively involved in uranium enrichment. In other words, if you want exposure to this space, you don’t have another choice. I could technically end this DD right here, but that would be lazy.

Instead, we need to dive deeper. We should understand exactly what we’re getting into, the risks, LEU’s financial health, their current revenue streams, future plans, and ultimately why I believe this stock has strong investment potential.

Lets begin our Deep Dive into LEU with a company overview:

First, some house keeping. When I say "LEU" I am referring to the company Centrus Energy Corp. Ticker "LEU". Because, LEU also means (Low Enriched Uranium), which I will state clearly. BTW, great ticker symbol.

Anyway, Centrus Energy Corp (NYSE American: LEU) is a U.S.-based nuclear fuel supplier with a unique position in the energy market. Headquartered in Bethesda, Maryland, Centrus plays a critical role in the nuclear fuel cycle, with a particular focus on uranium enrichment.

At its core, Centrus provides two main things:

- Nuclear Fuel Supply – The company sources, markets, and delivers enriched uranium fuel to utilities that operate nuclear power plants, both in the United States and abroad. This makes them a vital link in keeping reactors running and producing carbon-free electricity.

- Advanced Enrichment Technology – Centrus is also developing centrifuge technology to support the production of HALEU (high-assay low-enriched uranium). HALEU is enriched to higher levels than conventional reactor fuel and is expected to be the backbone of next-generation Small Modular Reactors (SMRs) and advanced reactor designs.

Centrus currently operates the American Centrifuge Plant in Piketon, Ohio, where it is ramping up HALEU production under contracts with the U.S. Department of Energy (DOE). This positions LEU as not just a traditional fuel supplier, but also a strategic player in the future of nuclear power in the U.S.

In short: Centrus is the only publicly traded American company with an active role in uranium enrichment. Their dual focus on supplying today’s nuclear fleet while pioneering tomorrow’s advanced fuels makes them both rare and potentially high-reward for investors looking at the nuclear energy theme.

CEO and Board Members:

One thing people often forget when picking stocks: who’s really in charge. I learned this the hard way about 10 years ago, investing in an ASX-listed company called Big Un Ltd (ticker BIG). The CEO was autistic and had a sketchy track record, so did his dad. One Google search, and you would've found out about there previous scam. The company got delisted, surprise, they ran another scam. I lost everything, even next week’s rent (back when I used to full port into risky penny stocks).

Lesson learned. So now: before we go all in on LEU, let’s dig into who the smucks behind the company are. Who’s leading it? What are their histories? Do they give you confidence?

| Person | Role | Background & Key Experience | Notes |

|---|---|---|---|

| Amir Vexler | President & CEO; Director | Ex-CEO of Orano USA; 20 yrs at GE/Hitachi in nuclear fuel; BASc Eng + MBA. | Deep nuclear & business experience; fairly new in CEO seat. |

| Mikel H. Williams | Chairman of the Board | Career board/gov oversight roles. | Strong governance, but not nuclear-ops heavy. |

| William J. Madia | Director | Former Director at Oak Ridge & PNNL; Battelle EVP; Stanford VP Emeritus. | Heavy scientific & DOE lab cred; strong gov ties. |

| Tina W. Jonas | Director | Ex-Undersecretary of Defense (CFO); roles at Optum/UnitedHealth. | Gov/finance/regulatory strength; less nuclear ops. |

| Ray A. Rothrock | Director | Nuclear engineer (MIT); venture capitalist; ex-CEO RedSeal (cybersecurity). | Mix of nuclear + tech/innovation; strategy-oriented. |

| Kirkland H. Donald | Director | Former CEO of defense consultancy; US Naval Academy graduate. | National security/oversight expertise. |

The standout operator is Vexler (CEO) with hands-on nuclear fuel industry leadership. The board is stacked with government, defence, and national lab insiders, plus members with nuclear science and engineering backgrounds. For example, William J. Madia is a veteran of Oak Ridge and Pacific Northwest National Labs, and Ray Rothrock holds nuclear engineering degrees from Texas A&M and MIT. This mix gives LEU strong credibility not just with Washington and the DOE, but also with the technical community, a crucial advantage since HALEU and enrichment depend heavily on U.S. government contracts and scientific oversight.

Finances:

Originally, I had pages of financial reporting below. In stead, here's a link to the company's finances:

📋 Key Financial Summary

Before we dive in, a quick note: if you’re serious about investing, it’s always wise to dig through the company’s own SEC filings and annual reports yourself. This summary only tells part of the story.

Recent Highlights (2024)

- Revenue: US$442.0 million

- Gross Profit: US$111.5 million

- Net Income: US$73.2 million

- Contract Backlog: Over US$3.4 billion in awarded contracts for HALEU and LEU supply

📈 Trends & Performance

- 2015–2019: LEU was consistently unprofitable. Revenue steadily declined through 2018, then flattened out. This was before the U.S. restarted domestic uranium enrichment efforts.

- 2020–2021: The big turnaround. Profitability returned, with 2021 showing unusually strong margins (~59%) despite modest revenue.

- 2022–2024: Revenue climbed steadily, with 2024 posting ~38% YoY growth. However, net income margins compressed (2024 margin ~16.6%), suggesting costs, investment ramp-up, or scaling effects are eating into profitability.

💡 Observations

- Cash & Liquidity:

LEU holds a strong cash reserve relative to debt, giving it flexibility to fund operations, ramp up HALEU capacity, and service obligations. The drop from ~$671M (end-2024) to ~$653M (Q1 2025) is minor and suggests stable liquidity with no major burn. - Backlog:

The $3.4B backlog provides multi-year visibility, but not all contracts are firm, some remain contingent. Execution and conversion to locked-in revenue will be critical. - Margins:

Core LEU operations are generating better margins, but some contracts are less profitable, so contract mix and efficiency will matter moving forward. - Cash Flow:

Operating cash flow and free cash flow are positive but modest. Future expansion, new centrifuge cascades, HALEU scaling, will require significant capex, and potentially new financing.

Revenue Breakdown: What’s Really Driving It?

Here’s the key point: despite the name, LEU isn’t currently making money from selling its own enriched uranium. They don’t yet have a commercial-scale enrichment operation online. The company has only produced small amounts of HALEU at its demonstration cascade in Piketon, Ohio, basically enough to prove it can be done. But so far, there’s no real commercial market for HALEU because the SMRs that would use it are still years away from deployment.

So where is their revenue coming from?

- Contract Services (Majority of Revenue): LEU generates most of its revenue through long-term contracts with the U.S. Department of Energy (DOE) and other government agencies. These contracts pay them to manage uranium, perform technical services, and advance HALEU demonstration projects. Think of it as “getting paid to build the factory and run the R&D,” not yet to sell the product.

- LEU Sales (Resale, Not Production): Some revenue comes from buying enriched uranium or natural uranium on the open market (from third parties like Russia or global suppliers) and then reselling it to utilities under existing contracts. This gives them a line of business, but it’s not from their own centrifuge output.

- Fuel Fabrication & Engineering Services: Smaller revenue streams come from technical support, consulting, and nuclear fuel services tied to the DOE and other nuclear operators.

- HALEU Development Contracts: The U.S. government has awarded over $3.4 billion in contracts for HALEU production and related services. These show up as backlog and staged revenue as work is completed.

- LEU is still “pre-revenue” in the sense of producing and selling its own enriched uranium. Their current revenue is effectively “project-based”, government contracts, reselling purchased uranium, and DOE-funded HALEU demonstration work. The real upside comes when SMRs are commercialized and LEU can actually sell HALEU fuel at scale.

The revenue breakdown is something like this:

| Segment / Revenue Source | Approx % of Recent Revenue* | Notes |

|---|---|---|

| LEU Segment (SWU / LEU deliveries / resale of enrichment services etc.) | ~ 70-80 % | This is the bulk of revenue. Includes things like separative work units (SWU), uranium hexafluoride or uranium feed, deliveries under long-term LEU contracts. From Q1 2025, revenue from LEU segment was $51.3M of $73.1M total. (investors.centrusenergy.com) |

| Technical Solutions / HALEU Contract Work | ~ 20-30 % | This segment covers HALEU production contracts, technical services, R&D, demonstration work under fee/incentive contracts. In 2024, this segment made about $92.1M. (Nasdaq) |

So, 70-80% coming from enriched uranium resales and 20-30% coming from technical solutions and HALEU contract work.

Centrus has managed to report a profit for three consecutive years, remarkably, without yet having its primary product (enriched uranium) on the market. That in itself is noteworthy. Many companies in a similar position rely heavily on issuing debt or diluting shareholders through new equity to stay afloat. Instead, Centrus has found alternative revenue streams and cost-management strategies that allow it to generate earnings before its main line of business is fully operational. This ability to remain profitable without core product sales underscores both the resourcefulness of management and the uniqueness of its business model.

Honest Report: Is LEU Overvalued, Undervalued, or Somewhere in Between?

Here are my thoughts, weighing the evidence:

Strengths / Justification for a High Valuation

- LEU is showing real profitability now (not just potential), with significant turnarounds in some recent quarters, this is positive and supportive of investor confidence.

- The nuclear / uranium sector is getting renewed attention (energy security, policy, etc.), which lends a tailwind for companies like Centrus.

- They seem to have healthy cash balances and manageable debt (~$430M in debt vs ~$833M cash & equivalents per recent data), so balance sheet risk is less scary than for some speculative names.

Risks / What Makes the Valuation Seem Aggressive

- Current P/E and Forward P/E are high compared to both LEU’s historical averages and many peers, paying 30-40× earnings (or more) means expectations are high. If earnings slow, growth misses, the valuation could be punished.

- Some forecasts suggest declining EPS growth in certain forthcoming years, which implies that current earnings may not keep accelerating. If revenue or margins get squeezed, the premium may shrink.

- The market may be already pricing in future contracts / policy wins; that is, a lot of “good news” may already be reflected in the stock price, leaving less upside unless LEU continues to overdeliver.

Conclusion on valuation

On balance, LEU is trading at a premium valuation. This doesn’t necessarily mean it is wildly overvalued — investors may be pricing in the company’s recent profitability, strong sector momentum, and favourable policy tailwinds. However, the risks are real: a single earnings miss, weaker growth trajectory, or policy setback could trigger a sharp correction, given how far current valuation metrics sit above historical norms.

In short, LEU’s valuation is undeniably elevated, suggesting that much of the optimism about its future may already be reflected in the share price. After all, the stock has already climbed more than 500% in the past year — a run-up that leaves little room for disappointment.

Government Contracts & Public Sector Dependency

LEU (Centrus Energy) is deeply linked with U.S. federal government contracts — especially through the DOE — which form a cornerstone of its business model. Since 2019, Centrus has held a multi-phase HALEU Operation Contract with the Department of Energy, under which it has:

- built and licensed a centrifuge cascade in Ohio to produce HALEU for federal uses;

- delivered milestone quantities (20 kg initially, then ~900 kg in Phase II, with ~920 kg already delivered) to DOE;

- earned a contract extension through mid-2026 valued at roughly US$110 million, with options for years beyond that pending further appropriation;

- been selected among a handful of companies in DOE’s HALEU enrichment contracts whose total pool is in the billions (≈ US$2.7B) and supported by over US$3.4B in federal appropriations.

This government tethering gives LEU both strength (secured, policy-backed demand and funding) and risk (political, legislative, regulatory, and funding dependency). Any shift in policy, delays in appropriations, or failure to meet government milestones could materially affect its financial projections.

Backlog: What It Is & Why It Matters for LEU

As of June 30, 2025, Centrus reports a backlog of US$ 3.6 billion, which includes roughly US$ 2.7 billion in the LEU segment and about US$ 0.9 billion in its Technical Solutions segment.

What this means:

- The LEU backlog includes both definitive contracts (firmed, signed agreements) and contingent commitments, amounting to about US$ 2.1B in contingent LEU sales. Some of those are already under definitive agreement; others require further investment or formal contract finalization.

- The backlog gives Centrus visibility and a foundation of expected future revenue, which supports its expansion planning, investment in capacity, and ability to justify build-out in plants (e.g. at Piketon).

- But not all backlog is equal. Contingent parts carry risk: delays, regulatory issues, capital needs, or unfavourable margin shifts may reduce what actually flows into revenue or profit.

In summary: the backlog is strong, and gives LEU a favourable starting runway. However, the degree to which it translates into real earnings depends on converting contingencies, maintaining execution, and managing external risks.

Part 4 Summary:

Centrus Energy (LEU) occupies a truly unique position in the market: it is the only U.S.-listed enrichment company, led by a management team with deep nuclear and government ties, and backed by a board heavy with scientific and policy expertise. Financially, it has managed to post profits without yet selling its own enriched uranium at scale — largely by leveraging government contracts, technical services, and resale operations. The valuation is undeniably rich, reflecting optimism around future HALEU demand and policy tailwinds, but this comes with the risk of sharp corrections if execution slips or political winds change. With a $3.6B backlog stretching out to 2040 and more than $3.4B in DOE contracts underpinning its strategy, LEU offers rare exposure to a sector that is both strategically important and capital-intensive.

Part 5: Final Conclusion and summary

In a nutshell, Centrus Energy (LEU) is the United States’ only uranium enrichment company, with proven capabilities in both LEU (fuelling the current fleet of reactors) and HALEU, where it operates the world’s first HALEU enrichment plant. The company has already produced and delivered 900 kg of 5- 20% enriched uranium under DOE contracts, a milestone that no other Western supplier has achieved.

This positioning is powerful. If Small Modular Reactors (SMRs) take off, Centrus will be at the centre of demand, with an unmatched first-mover advantage in HALEU. If SMRs don’t gain traction, Centrus can still do reasonably well as the only U.S. enrichment option for LEU, with steady government support and long-term contracts for existing reactors. The SMR scenario is the rocket fuel, the upside case where demand for HALEU explodes, not just in the U.S. but globally.

The company’s close alignment with the Department of Energy is another critical strength. Government support is woven into its DNA, and Centrus has consistently won contracts under both Democratic and Republican administrations. This suggests that political risk is lower than it might appear, energy security and nuclear independence are bipartisan priorities.

Financially, Centrus is in a unique position: it is still technically pre-revenue in terms of selling its own enriched uranium, but has nevertheless found ways to remain profitable through contracts, services, and resales. Few companies can say the same.

Risks

Of course, risks remain, and they are not trivial:

- Valuation risk: LEU trades at a premium, and much of the “future upside” may already be priced in. The big unknown is whether SMR adoption happens fast enough to justify today’s multiples.

- Execution risk: Scaling enrichment capacity, securing long-term feedstock, and meeting delivery timelines all require flawless execution. Any hiccup could hurt credibility and share price.

- Liquidity risk: With only ~17.5M shares outstanding and ~16.8M in the float (≈75% institutionally held), LEU has a tight share structure. Even modest buying or selling can push the stock around, up 25% one day, down 20% the next. Volatility is the norm here, not the exception.

- Timing risk: The breakthrough moment could come tomorrow, next year, or in a decade. Investors must decide how patient they are willing to be, and whether they can stomach years of sideways or choppy price action while waiting.

The Investment Case

Personally, I believe the risk/reward is worth it. LEU represents a once-in-a-generation chance to invest in the rebirth of America’s uranium enrichment industry. The backlog, the government support, the proven HALEU capability, all of these form a foundation that could see Centrus become the indispensable player in U.S. nuclear fuel independence.

My approach: I’d be comfortable allocating up to 10% of a portfolio to LEU, with a hard stop around –30% to –50% to account for volatility. The wide stop is necessary because of the small float; price swings are inevitable. For me, discipline is key: if the stock moves against me beyond my limit, I step aside and admit I was wrong. Remember, a 50% drop requires a 100% return to breakeven and I'm not a patient person, so at a 30% drop, I walk away.

Bottom Line

LEU is a high-risk, high-reward play. It could drift sideways for years, or it could 10× if SMRs hit commercial deployment and HALEU demand surges. All it takes is one breakthrough, one contract, one announcement, and this stock could move like a rocket ship.

If you believe in the nuclear renaissance and can stomach volatility while waiting for the inflection point, Centrus Energy may be the most asymmetric play in the sector. As it stands, Centrus is the only U.S. company currently producing HALEU, creating a significant supply bottleneck, and meaningful upside if SMR demand accelerates.

Final Thoughts:

I like the stock.

If you found value in this LEU DD, feel free to leave a tip, or come back and donate if the trade makes you a profit. Every contribution, big or small, helps keep these reports coming and motivates me to keep digging deeper.

LEU Position Update - Post DD Report

21/09/2025

LEU up 53% Since recommendation 14 days ago.

3/10/2025

LEU up 80.1% Since recommendation 28 days ago.

7/10/2025

LEU up 84.06% Since recommendation 32 days ago.

8/10/2025

LEU up 90% Since recommendation 33 days ago.

16/10/2025

LEU up 125% Since recommendation 41 days ago.